BIRD: The Banks’ Integrated Reporting Dictionary

What is BIRD?

Banks often face challenges in interpreting and implementing new or updated regulatory frameworks. They must navigate through complex requirements, extract relevant data from their internal systems, and transform it to meet regulatory standards. This process can be confusing, as different banks may interpret regulations differently and use various sources of data, leading to discrepancies in reported numbers.

To address this issue, Banks’ Integrated Reporting Dictionary (BIRD) collaboration between the ECB, euro area NCBs, banking industry software providers, including Suade. BIRD aims to streamline reporting processes by providing a standardised methodology and data model. This will help banks organise their internal data more efficiently and meet their reporting obligations with greater ease, ultimately improving the quality and comparability of reported data across banks.

Benefits of Bird to Banks

The ECB's overarching strategy for streamlining banks' regulatory data reporting involves establishing a unified standardised reporting framework. This framework will be supported by two main components: BIRD and IReF. BIRD will serve as a foundational element and will be expanded to accommodate potential country-specific requirements. Additionally, it will enable local extensions beyond the scope of IReF, while adhering to principles aimed at minimising redundancies across countries within the Eurozone. The Integrated Reporting Framework (IReF) will integrate the Eurosystem’s statistical requirements for banks. It will be applicable across the euro area and may also be adopted by authorities in other EU Member States. IReF focuses mainly on the ECB’s requirements in terms of banks’ balance sheet and interest rate statistics, securities holdings statistics and granular credit data.

Implementation costs vs future savings

Transition costs, including one-time implementation expenses and potential parallel reporting, pose significant challenges for institutions. Despite this, the benefits of adopting BIRD and IReF in the medium term are substantial. BIRD's common data language enhances communication and transparency across borders, while IReF reduces reporting workload through integrated processes. Future regulatory updates will be easier to implement, aided by the EU's push for machine-readable regulations. Moreover, cost savings are anticipated through streamlined reporting obligations and facilitated communication with supervisory authorities. Standardised data definitions also simplify software changes and enable the adoption of modern cloud technologies.

BIRD methodology and key components:

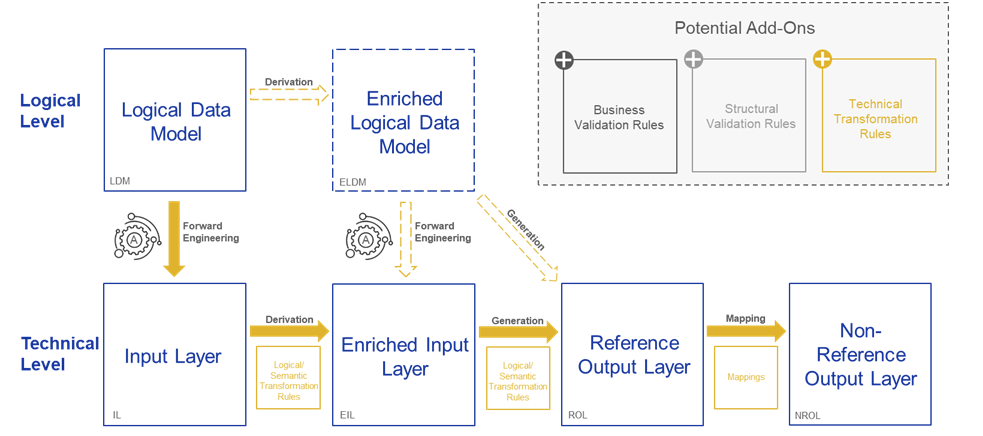

Source: European Central Bank Ecosystem – BIRD Methodology

If you are currently working on improving your regulatory reporting processes or would like to learn more about how Suade is automating regulation for global financial institutions, then please

FIRE-BIRD:

FIRE x Bird

Discover how Suade's innovative solution seamlessly integrates with BIRD for enhanced regulatory reporting frameworks.

BIRD history

In late 2015, the STC of the European System of Central Banks initiated a BIRD pilot for AnaCredit and SHS statistics, involving volunteer central banks and banks. The pilot concluded successfully in April 2017, with comprehensive documentation published. By June 2018, BIRD expanded to include EBA's FINREP standards and methodological improvements. In 2020, the Data Modeling and Testing Work Streams reviewed and enhanced the BIRD process and documentation. The BIRD Steering Group revised its scope and objectives in 2021, introducing enhanced components and user-friendly transformation rules. Alignment with IReF and updates to FINREP are future priorities.