Retiring the Refined Methodology to Pillar 2A

PS18/25 and the subsequent impact on SS31/15 + SoP5/15

PRA Releases in focus

PS18/25 - Retiring the refined methodology to Pillar 2A - near-final.

PS18/25 - Key Takeaways:

- The PRA is sticking with the proposal to fully remove the refined methodology on the 1st January 2027, instead of introducing a transitional period which may have potentially aligned with that of the output floor.

- Despite responses to CP9/24 that were against fully retiring the refined methodology, the PRA still holds the view that the refined methodology is operationally burdensome as it primarily acts as a proxy for the increased risk sensitivity which Basel 3.1 will now maintain going forward.

- Further, the PRA has also dismissed arguments that Basel 3.1 CR SA is overly conservative compared to the IRB approach, especially given the introduction of the output floor.

- Despite suggestions that the removal of the refined methodology may increase TCR, the PRA expects a broadly neutral impact on average, after refreshing their analysis based on more recent reg returns. Around half the firms that currently have the refined methodology are expected to see a reduction in TCR & buffers.

Detailing the amendments to SS31/15 & SoP5/15 after the release of PS18/25 which are effective from the 1st of July 2026:

Changes to SS31/15:

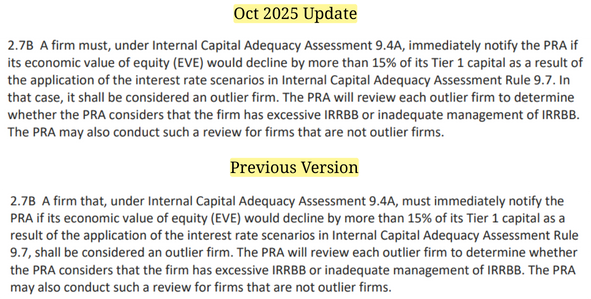

Very minor clarifications in 2.7B (Supervisory Actions)

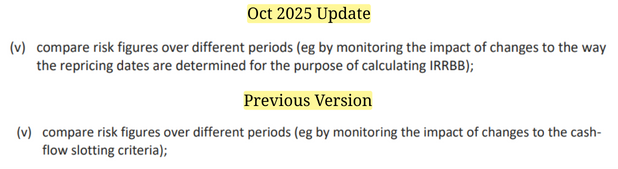

Changes to paragraph 2.8B(v) (General Requirements on IRRBB):

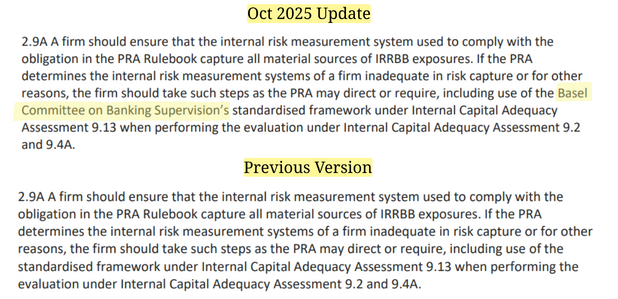

Very minor clarification in 2.9A (Measurement of IRRBB):

Changes to PS18/25:

- The PRA is currently undertaking a review of Pillar 2A methodology on IRRBB (subject to separate consultation). Due to requests for further clarifications off the back of CP9/24, the PRA has decided not to implement the proposed changes in paragraphs 7.4 & 7.27 (see below) of the final SoP5/15 at this time.

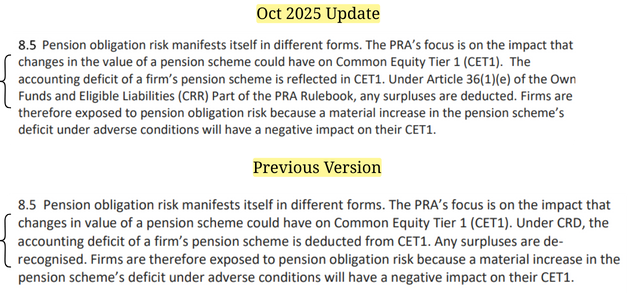

Update to Pension Obligation Risk in SoP5/15: