Summarising Near-Final Rules for SDDTs

PRA Release in focus

- PS20/25 - The Strong and Simple Framework: The simplified capital regime for Small Domestic Deposit Takers (SDDTs) - near-final

Contents:

- Material changes.

- Descoped & amended templates.

- Areas with improved guidance.

- Additional takeaways.

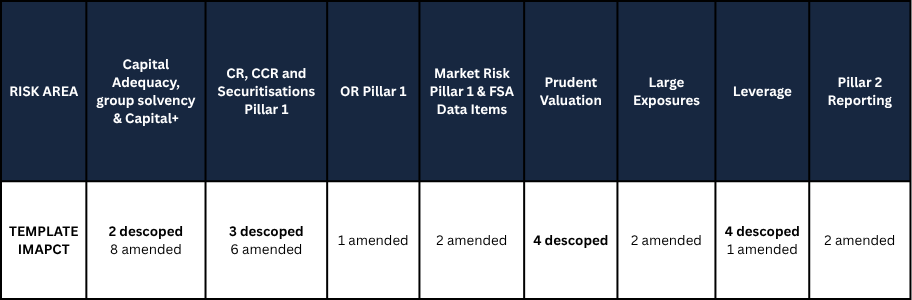

Number of templates affected by risk area in this PS:

The PRA has released the near-final (de facto final) rules for SDDTs in the UK, with the official final rules set to be published in Q1 2026. After taking into account the responses to CP7/24 and SDDT-related responses to other CPs, the PRA have made a number of adjustments & clarifications to the policy proposed as part of the Strong & Simple Framework.

Material changes to the SDDT-regime:

- Removal of the bucketing approach for operational risk in the Pillar 2A framework.

- Minor amendments to the calculation of the Pillar 2A credit concentration risk (CCoR) base add-ons, including exclusion of covered bonds.

- Amendments to the proposed Pillar 2A CCoR single-name concentration monitoring to improve risk sensitivity and transparency for firms. The cluster limit excludes exposures to credit institutions from among the exposures subject to the cluster limit & the limit has been tightened from 300%-200%.

- Reductions to the minimum expected frequency of Pillar 2A and Pillar 2B updates to ICAAP documents (excluding new and growing banks) from annually to every 2 years.

- Amendments to the treatment of certain exposures by mandating full deduction of qualifying holdings outside the financial sector, certain securitisation positions, and free deliveries, instead of applying a threshold-based approach.

- Increasing the number of descoped templates for SDDTs from 38 to 51.

- Introducing SDDT-specific versions of 4 additional templates.

Templates being descoped in this PS:

- C 05.01, 05.02, 11.00, 33.00, 34.06, 32.01 - 32.04.

- LV 40.00 - 44.00.

Amended templates:

- C 01.00, 03.00, 04,00, 06.01, 06.02, 09.04, 13.01, 14.00, 14.01, 28.00(c), 29.00(c).

- OF 02.00, 07.00, 09.01(b), 16.00, 22.00, 90.00.

- PRA 111, 113, 114.

- LV 47.00.

- FSA071.

PRA’s improved guidance:

- Setting clearer expectations for scenario analysis under the SDDT Pillar 2A operational risk methodology.

- Clarifying the implications of breaching the cluster limit in the SDDT Pillar 2A framework and confirming that its design is aligned with the more recent large exposures proposals.

- Providing an example of the new SDDT scenarios in order to illustrate how it differs from current scenarios for non-systemic firms and serves as a severity benchmark for firms’ ICAAP stress testing.

- Explaining the RMG scalar by including a stylised example of how the related capital add-on is calculated.

- Clarifying expectations for qualitative reverse stress testing, including the types of analysis that may be appropriate in a non-quantitative context.

PS20/25 - Additional Takeaways:

- The PRA considers that the total-asset threshold for SDDT-eligibility remains fair. Regardless, The PRA has committed to reviewing the SDDT criteria no later than the end of 2028.

Pillar 1

- The PRA retains the view that the Basel 3.1 CR SA is simple and proportionate enough to apply to SDDTs as well as firms bound by the full Basel 3.1 rules.

- Minor clarification around expectations for SDDTs to collateralise their exposures & use CCPs to clear derivative contracts. SDDTs are ‘encouraged’ to and not ‘required’ to.

- The PRA is considering the simplification of the treatment of settlement risk as an element, since SDDTs have immaterial exposures to this risk.

Pillar 2A

- Firm-specific add-ons for SDDTs will be informed by the firm’s scenario analysis & supervisory judgement (replacing the bucketing approach).

- Further assessment of the CCoR methodology for SDDTs will be enacted in Phase 2 of the Pillar 2A review, with particular focus on SME exposures.

- The PRA may conduct off-cycle Capital Supervisory Review & Evaluation Process (C-SREP) assessments in certain exceptional circumstances e.g. where findings relating to a firm impacts the accuracy of previously set capital requirements.

- The PRA continues to consider an approach to indexing thresholds in the broader prudential framework e.g. retail threshold has not been updated since 2004.

- The removal of bucketing for operational risk should mitigate concerns around holding additional management buffers to avoid ‘cliff-edges’ as firm’s grow and risk profiles change.

- Pillar 2A lending adjustments to follow the same approach as for non-SDDTs despite a few exceptions relating to calculating ΔRWA & the capital adjustment factor (CAF).

Capital Buffer Framework

- Additional clarity around how the RMG scalar is considered when setting the Single Capital Buffer (SCB) has been added via paragraph 12.26 of SoP5/25. The PRA have also outlined clear reasons as to why the RMG does not overlap with Pillar 2A OR add-ons e.g. quantifiable vs unquantifiable risks.

- It’s confirmed that the SCB will be designed as a non-cyclical buffer to replace the current cyclical stress testing framework and will remain confidential.

- The PRA has provided additional clarity by publishing an example of the stress test scenarios for SDDTs & guidance around how the framework should work. These are detailed in Appendices 16 & 17 of the original publication. Capital injections are still to be excluded from scenarios.

ICAAP

- PRA retains the right to assess a firm’s ICAAP document annually if judged to be necessary, despite the new biennial review process.

- For firms who are encouraged to use reverse stress testing (RST) as part of their recovery plans, there is not much benefit in the reduced RST frequency. However, the PRA is proposing a reduction in the minimum recovery plan update frequency within CP14/25.

- The PRA will implement and produce an optional ICAAP structure (can be found in SS4/25).

- ILAAP updates & documentation confirmed biennial.